Our products Armos(QKD) and Tropos(QRNG) are now on GeM's portal

The digitalisation of the economy has impacted the financial services industry more than others. Digital financial transactions have replaced physical currencies. Banknotes were exchanged on trust. They were issued by trustworthy institutes in the country and used between parties without fear of doubt. Digital payments have tried to replicate the same model of trust. But, with the advent of quantum computers, that might change.

The encryption technology today replaces sensitive data using randomized tokens and secures the payment transaction using a cryptographic function called a cryptogram. But, the computational power of a quantum computer can jeopardise these encryption methods. The solution to the problem of quantum computing is another quantum technology that uses quantum light to produce unforgeable quantum cryptograms.

Quantum Cryptography

Cryptography methods that use the fundamental principles of quantum mechanics are collectively called quantum cryptography. They are popular in cybersecurity and quantum technology fields for their potential to create a fortress of security around confidential data. Quantum channels can be implemented alongside classical channels to provide enhanced security.

Quantum Key Distribution (QKD) is a widely used quantum cryptography technique for communicating between two trusted parties. QKD is a proven method to establish quantum-secure connections of over 500 KMs on the ground using optical fibres and over 1000 KMs in free space using satellites.

QKD uses a secure key generated from the random polarisation of photons. An attempt to read the key disturbs the photons causing the key to collapse. The quantum state of photons detects the act of eavesdropping making the channel ultra-secure.

Though QKD is a fool-proof method of communication, there’s a possibility of adding another layer of security using quantum light.

Digital Payments Using Quantum Light

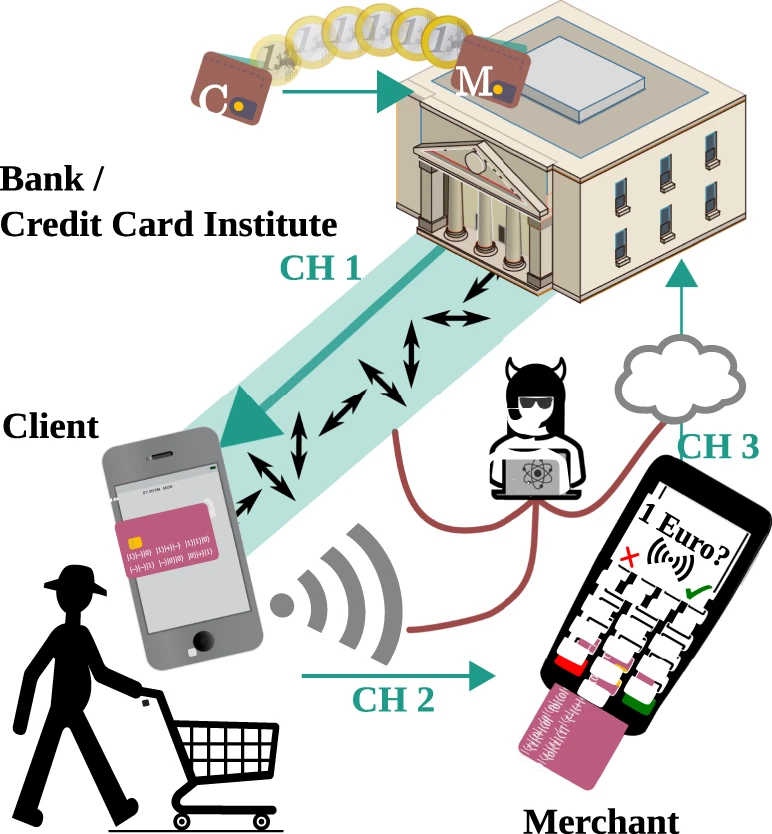

Let’s consider a traditional model of payment, it involves a bank, a merchant, and a customer. An assumption is made that only the customer and the bank can be trusted. All intermediate parties (merchants or other third-party vendors) could act maliciously.

The following image demonstrates the setup:

Simplified representation of quantum-digital payments.

When a payment is made, the bank sends a set of quantum states (in the form of quantum light) to the customer’s device. The device measures the quantum states and converts them into a quantum-secured token, a quantum cryptogram. The customer uses this token to pay the merchant, and the merchant contacts the bank for payment verification. If it’s accepted, then the money is transferred by the bank from the customer’s account to the merchant’s account.

The method has a very low probability of breaking down. It is also noise-resistant. The implementation of this technique is simple and cost-effective. In this system, the payment is sent over the quantum channel, and the cryptogram over the classical channel. If the cryptogram comes back malformed, then the payment will be rejected. This behaves like QKD, where the quantum channel transmits the sensitive data, and the classical channel checks for any malicious intent.

Concluding Thoughts

The use of quantum light in digital payments is a promising development that could add robustness to quantum cryptography. While the technology still reels under some challenges, such as the need for long-term quantum storage and the development of more robust light sources, the potential benefits are significant. The guarantee of one-time purchases and protection of sensitive customer data, even in the presence of potentially malicious parties, could revolutionise the security of digital transactions.

References: